CHICAGO, IL – A coalition of tax officials, state lawmakers and industry representatives agreed yesterday to establish an 18-state network for the purpose of collecting taxes on internet sales, an effort they hope will spur online retailers and Congress to get behind a mandatory national level program.Under current tax codes, consumers themselves are expected to pay sales taxes on internet purchases directly to their state of residence when they pay their annual income taxes. This taxation is not stringently enforced, however, and a 2004 study released by the National Governors Association and the National Conference of State Legislatures estimated that state and local governments lost between $15.5 billion to $16.1 billion in 2003 from untaxed internet sales. According to the Reston, Virginia-based research firm comScore Networks, online retail spending last year totaled $66.5 billion.

“Taxes that it was difficult to collect before will now be collected. And consumers will pay that,” said David Quam at the National Governors Association.

A 1992 U.S. Supreme Court ruling prevents states from forcing businesses to collect sales taxes unless the company has a physical presence in the state affected. The court cited the vast array of tax jurisdictions and widely varying definitions of taxable goods, such as fast food versus groceries, from state to state.

Organizers of the effort, which operates under the name of the Streamlined Sales Tax Project, are seeking to unify tax rules and definitions among states. They also hope to convince federal legislators to pass a new law to overcome the Supreme Court ruling and allow states to demand online companies levy the taxes themselves.

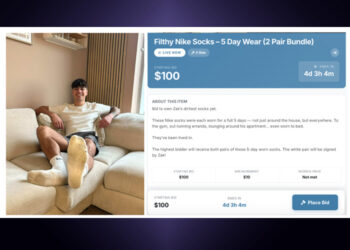

In what supporters call an “incentive” and critics call “coercion,” a one-year amnesty will be offered for e-commerce companies that may owe taxes on past online sales to any of the participating states. The amnesty may prove an attractive offer for a number of major retailers currently involved in legal disputes concerning whether they owe back taxes on internet sales.

In May, a California state appeals court ordered Borders.com, the online division of the Borders Group, to pay over $150,000 in back taxes to the state, because the company allowed customers who purchased books online to return them at the company’s physical locations.

In Illinois, an ongoing suit brought by the state against Gateway, Barnes and Noble, Blockbuster and several other retailers, alleges that the companies failed to pay millions of dollars in taxes on sales made to state residents. In December of last year, a number of companies, including the Target Corporation, Wal-Mart Stores Inc. and Office Depot Inc., settled their lawsuits with the state, paying Illinois a total of $2.4 million. Illinois’ case against Gateway and other major retailers is pending.

To be accepted as part of the Streamlined Sales Tax Project, a state must change its tax laws to match up with the others within the project. Thus far, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Nebraska, New Jersey, North Carolina, North Dakota, Oklahoma, South Dakota, and West Virginia are part of the project, with Arkansas, Ohio, Tennessee, Utah and Wyoming to be added within the next few years.